Investment options

Investments to suit your needs and stage of life

As a member, you have a choice when it comes to how your retirement savings are invested. You can choose from pre-mixed and single asset class investment options that let you mix and match how your super is invested. If you don’t make a choice, you’ll be automatically invested in our Lifecycle Investment Strategy. You can also choose to invest in this strategy at any time.

Before making an investment choice, you should read our Product Disclosure Statement (PDS).

We offer members the following investment options:

Lifecycle Investment Strategy

The strategy works by investing your retirement savings in a mix of the High Growth and Conservative Balanced investment options based on your age. The philosophy of the strategy is simple: to give you significant exposure to growth assets such as shares (the High Growth investment option) in the early stages of your working life, and then gradually reduce this as you get older by increasing your exposure to defensive assets such as bonds and cash (the Conservative Balanced investment option). This helps provide less volatile investment returns as you get older.

Read more in our Lifecycle Investment Strategy (PDF) factsheet or watch the video below for a quick overview of how the strategy works.

Five pre-mixed investment options

Pre-mixed across asset classes to match different investor risk profiles.

High Growth

| Overview | High Growth accepts higher risk to maximise returns. It invests primarily in shares, that aim to maximise returns by taking greater risk, with a small allocation to defensive assets such as bonds and cash. |

| Risk level | High. |

| Investment time frame | Suitable for people who wish to invest their super for five or more years. |

| More info | Read the High Growth factsheet (PDF) |

Growth

| Overview | Growth aims to optimise the risk and return potential. It invests primarily in shares, that aim to maximise returns by taking greater risk, with some allocation to infrastructure, alternatives and defensive assets. |

| Risk level | High. |

| Investment time frame | Suitable for people who wish to invest their super for five or more years. |

| More info | Read the Growth factsheet (PDF) |

Balanced

| Overview | Balanced aims to provide a balance of risk and return. It invests mainly in shares and fixed income, with a small allocation to property, infrastructure and other alternatives. |

| Risk level | High. |

| Investment time frame | Suitable for people who wish to invest their super for four or more years. |

| More info | Read the Balanced factsheet (PDF) |

Indexed Defensive

| Overview | Indexed Defensive is a low-cost passively invested option. Indexed Defensive invests the majority of its defensive assets in fixed income and cash and its growth assets in Australian and International Shares. |

| Risk level | Medium to High. |

| Investment time frame | Suitable for people who wish to invest their super for three or more years. |

| More info | Read the Indexed Defensive factsheet (PDF) |

Secure

| Overview | Secure aims to provide a low to medium risk investment with 90% invested in cash, a defensive asset that has a lower short-term risk but provides low long-term returns. It also invests 10% in Australian shares, which are a growth asset. Please note, although Secure is our lowest risk pre-mixed investment option, it's possible it could generate a negative return, particularly over the short-term. |

| Risk level | Very low. |

| Investment time frame | Suitable for members who want to invest for two or more years. |

| More info | Read the Secure factsheet (PDF) |

Six single asset class investment options

Single asset class investment options invest in one asset class only; each with different levels of risk and return potential. They allow you to build your own asset allocation across multiple asset classes.

- Australian Shares (PDF)

- International Shares (PDF)

- Property (PDF)

- Bonds (PDF)

- Cash (PDF)

- Term Deposit (PDF)

Where do we invest your super?

Term Deposits

The Term Deposit investment option invests in the fixed term deposit products of Australian Authorised Deposit-taking Institutions (ADIs) chosen by Mine Super, such as banks, building societies and credit unions.

We recommend you read our PDS and seek financial advice before investing in the Term Deposit investment option.

Latest Term Deposit interest rate

There is no interest rate available at this time. If you apply now you'll be invested at the next Term Deposit interest rate, which will be published on Monday afternoon, 29 April 2024.

Invest in the Term Deposit investment option

You can invest in the Term Deposit option at any time by completing the Invest in a Term deposit option form (PDF) and returning to us.

Note: Valid applications received by 5pm on a Thursday, when rates have been published for that week, will be invested the following Tuesday. Applications received after this cut off will not be invested until we next have a Term Deposit available and will be invested on the Tuesday following that week.

Reinvest in the Term Deposit investment option

Standard Risk Measure (SRM)

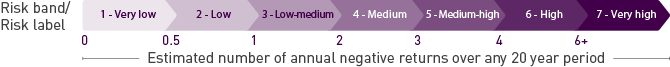

The SRM allows you to compare investment options by considering the expected number of negative annual returns over any 20 year period.

The SRM isn’t a complete assessment of all forms of investment risk. For example, it doesn’t detail what size a negative return could be, nor the potential for a positive return to be less than your objective. Further, it doesn’t consider the impact of administration fees and tax on the likelihood of a negative return.

How does the SRM show risk?

The SRM places this risk into one of seven risk labels, ranging from very low to very high. If the risk is ‘low’, we’d expect one or less years of negative returns over 20 years. If the risk is ‘high’ we’d expect between four and six years of negative returns over any 20 year period, as shown in the diagram below.

These negative returns can be experienced several years apart or several years in a row within a 20 year period.

How is the risk for each option worked out?

We develop a set of capital market assumptions (return, volatility, correlation, etc) for the asset classes which make up the investments of our investment options.

Using the portfolio weights and these assumptions, we apply portfolio simulation techniques to determine the probability of a negative return occurring over a one-year period.

This probability is then multiplied by 20 to give an estimate of how many years in 20 we expect an investment option to deliver a negative return. This then feeds into our risk assessment which calculates the expected risk bands / labels for each of our investment options.

What kind of information do we consider?

We consider how returns and volatility are affected by different economic conditions, such as inflation, economic growth and asset prices.

Investment costs

Consistent with regulatory guidelines, we don’t consider the impact of administration fees or tax and we only take into account investment management fees.

What else should I consider when thinking about the risks of my super investments?

The real world is complex and not always rational. This means mathematical theories may not always play out in practice. So, while the SRM can help you understand your investment risk, it shouldn’t be the only consideration.

For example, the SRM doesn’t show you:

- how big a negative return will be;

- whether you’ll get the returns you’re after; and

- how fees and taxes will impact your return.